Are you navigating the complex landscape of the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) and wondering if your income disqualifies you? The good news is that while income is a primary factor, it's not always the only one, and there are often pathways to eligibility even if your earnings exceed the standard limits.

The U.S. Department of Agriculture ("Department") regularly updates its income eligibility guidelines, which state agencies utilize when determining who qualifies for WIC. Many families, particularly those who are just above the income threshold, worry that their income will automatically prevent them from receiving these vital benefits. However, its important to remember that various strategies and special circumstances can significantly impact your eligibility.

To truly understand your options, it's important to dissect the nuances of WIC eligibility. For instance, you can check your potential eligibility by completing the WIC prescreening tool. This initial step can provide a quick assessment of your chances of qualifying. It is important to grasp how income is assessed for WIC participation.

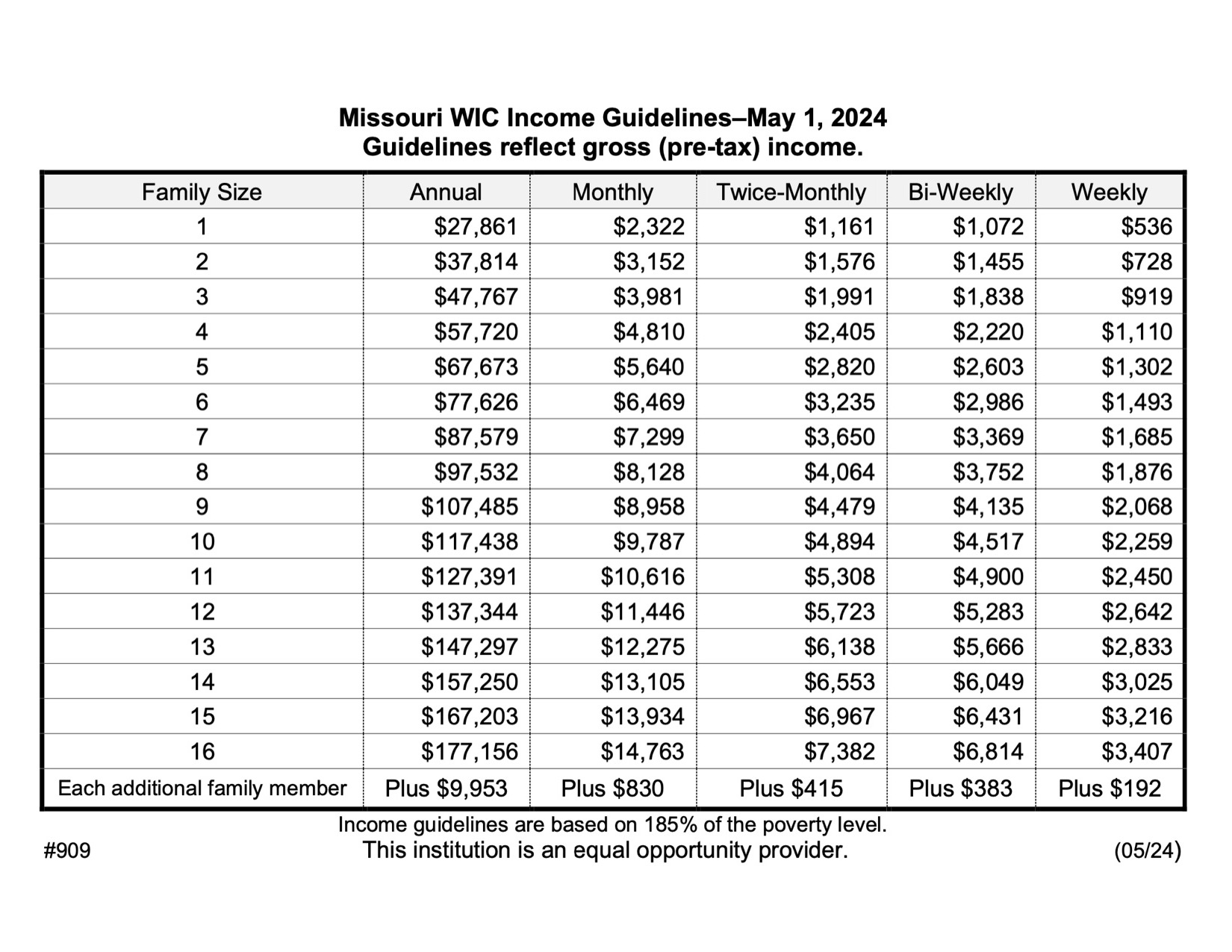

Generally, to be eligible based on income, your gross income (the amount before any taxes are taken out) must fall at or below 185 percent of the U.S. poverty income guidelines. This threshold serves as a foundational benchmark. States have the flexibility to establish their own income limits, but it is uncommon for these limits to be lower than the federal guidelines. Even if your income is over the limit, there are some special circumstances which may allow you to qualify for the program.

Let's delve deeper into the realities of qualifying for WIC, and how families are able to access this support, even when they are facing seemingly insurmountable income barriers.

| Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) Eligibility Factors | |

|---|---|

| Category | Details |

| Income Eligibility |

|

| Category | Details |

| Household Size |

|

| Other Factors |

|

| Special Circumstances |

|

| Reference: USDA Food and Nutrition Service |

It is important to understand that you are not required to be on a public assistance program to be eligible for WIC. In fact, many families who are working and not receiving other forms of assistance qualify for this support. Also, the eligibility process has become easier, as you can start the application process by phone to begin with. The availability of a WIC prescreening tool makes it even easier for those seeking information.

Many families face challenges when trying to qualify for the special supplemental nutrition program for women, infants, and children (WIC) due to income restrictions. For instance, one individual shared their experience of applying for WIC. They mentioned they made over $40,000 but still got approved. This was attributed to being in between jobs and being unable to afford health insurance, which led to them getting pregnancy Medicaid. Their daughter also received Medicaid, and in New York State, children on Medicaid automatically qualify for WIC. This highlights a key aspect of the program: the interconnectedness of different aid programs. This applicant's story underscores how WIC can offer crucial assistance. They received eight cans of formula, helping significantly during a transitional period.

For those wondering, "Can I still apply for WIC if I earn above the income limit?" The answer is a resounding yes. Circumstances such as a large family or medical problems may increase your eligibility chances, even if your income slightly exceeds the typical limits. While the income guidelines for WIC are relatively straightforward, other programs like SNAP might have more involved eligibility criteria, including gross income, net income, and asset tests. However, keep in mind that not every test applies to every household.

For instance, income limits for WIC in Texas for July 1, 2024, through June 30, 2025, have been established to give families a clear idea of the financial boundaries. Each state will have its own guidelines that are up to date. For families who want to find out the exact income limit, they should review the current income guidelines and the application process FAQs to get started. Furthermore, resources like the WIC chatbot can help determine eligibility.

If you are worried about income, remember that the gross (before taxes) wages listed on your check stubs, based on how often you are paid (income interval) and your household size, must be less than or equal to the amounts in the official chart. If the number of people in your household is over eight, you should call your local WIC office for more specific information.

If you are in a situation where your income is above the typical limits, it does not mean that WIC is out of reach. There are actions you can take. While income is essential, its not the only determinant. Here are some strategies you might want to look into:

- Explore Special Circumstances: Does your family have special medical needs or other hardships? Share your situation with WIC officials.

- Check the State Guidelines: Be sure you have carefully reviewed the income guidelines and any special provisions available in your state.

- Ask for Help: Seek help from WIC representatives to clarify your situation. They can help identify any available options.

WIC can be very helpful for families, especially for formula. It also offers support for breastfeeding mothers, and this is also a factor when considering eligibility. If you are not breastfeeding, then there are several other options available, and WIC representatives can point you in the right direction.

If you're struggling to access WIC benefits despite a seemingly high income, youre not alone. Many families deal with income restrictions when applying for this nutrition program. By familiarizing yourself with these resources, you can start on your path to access vital support.