Are you prepared to safeguard your loved ones' financial future, even when you're no longer here? Securing the right life insurance policy is not just a responsible choice; it's a cornerstone of financial planning, offering peace of mind and a legacy of protection.

Life insurance comes in various forms, each with its own set of features and benefits. Understanding these differences is the first step towards making an informed decision. Among the most common types are term life, whole life, and universal life insurance. Term life insurance provides coverage for a specific period, while whole life insurance offers permanent coverage with a cash value component. Universal life insurance, on the other hand, combines death benefit protection with a cash value component that can be adjusted over time. Aaa life insurance company offers a variety of life insurance coverage options that include term, whole life, and universal life insurance protection.

For a comprehensive understanding, let's delve into the specifics of life insurance policies offered by the AAA Life Insurance Company, examining their various types, benefits, and how they can cater to your unique needs.

To get a quote from AAA life insurance, you may call at 844.759.9758 or visit their website to get a free quote online.

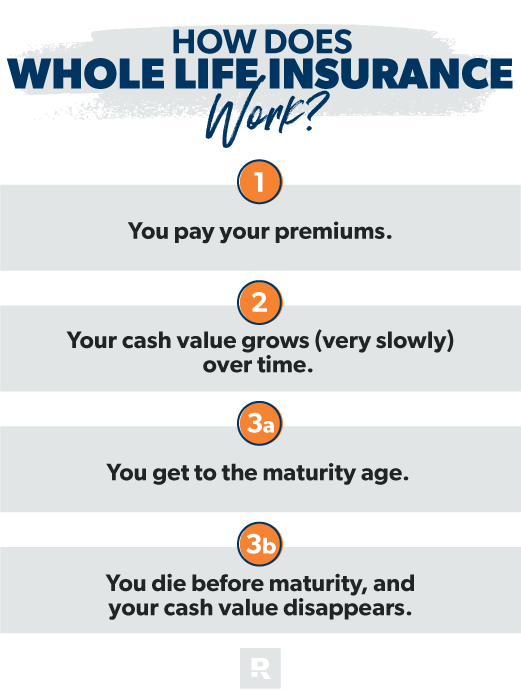

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as premiums are paid. One of the key advantages of whole life insurance is its level premiums, meaning the cost of your policy remains the same throughout its duration. Additionally, whole life policies build a cash accumulation value, which grows over time on a tax-deferred basis.

Before considering a life insurance policy, it is advisable to understand its terms and conditions. This includes the details of the benefits, the exclusions, and other policy provisions. For complete terms of the insurance coverage, please contact your insurance professional or refer to the policy. Life insurance underwritten by AAA Life Insurance Company, Livonia, Michigan. AAA Life Insurance Company is licensed in all states.

The main features of a whole life insurance policy is listed below.

| Feature | Description |

|---|---|

| Permanent Coverage | Provides lifelong protection, as long as premiums are paid. |

| Level Premiums | Premiums remain the same throughout the life of the policy. |

| Cash Value Growth | Accumulates cash value over time, tax-deferred. |

| Loans and Withdrawals | Allows policyholders to borrow against the cash value. |

| Death Benefit | Pays a death benefit to beneficiaries upon the insured's death. |

AAA Life Insurance

In contrast to whole life, term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. If the insured dies during the term, the death benefit is paid to the beneficiary. However, term life policies do not build cash value. Aaa offers Term, express term, whole, or universal insurance.

Universal life insurance combines death benefit protection with a cash value component. Unlike whole life, universal life policies offer more flexibility, allowing policyholders to adjust their premiums and death benefit within certain limits. The cash value in a universal life policy grows based on the performance of the policy's underlying investments.

For those seeking simplicity and affordability, AAA Life offers a simple whole life insurance policy that doesn't require a medical exam. Applicants just have to answer a few questions to determine approval, choose between $5,000 to $25,000 in coverage, and let AAA Life handle the rest.

AAA Life Insurance Company offers a variety of life insurance products and services to meet the needs of families in every stage of life. Whether you've already chosen a policy or are still exploring, AAA makes it easy to get a quote or get in touch if you have questions. You can get an insurance quote online or by phone.

AAA Life insurance for seniors provides financial protection for your loved ones that is built around your family's needs.

For applicants with health conditions, a guaranteed issue whole life insurance policy can be a suitable option. This type of policy typically does not require a medical exam, making it accessible to individuals who may have difficulty qualifying for traditional coverage. This guaranteed issue whole life policy is referred to as graded benefit whole life insurance. Subject to age requirements and policy limit restrictions.

For those seeking cash value growth, whole life insurance is an excellent choice. The cash value of a whole life policy accumulates over time and can be a valuable asset for future needs. Cash value refers to the portion of a permanent life insurance policy that accumulates savings over time. It is a feature found in policies like whole life and universal life insurance. Unlike term life insurance, which has no cash value, these permanent policies build up a savings component.

Whole life insurance can also be an option for foreign nationals who are seeking to preserve wealth and leave a legacy. With coverage ranging from $30,000 to $75,000, it can assist with final expenses and debts, supplement a term life insurance policy, and provide additional income.

When choosing a life insurance policy, consider the features and benefits that are most important to you. Whats most important to you? The key is to find a policy that fits your budget, meets your coverage needs, and provides the peace of mind you deserve. Aaa life is dedicated to providing educational resources about traditional term life insurance policies and the other excellent insurance packages they offer. Weve provided informational articles and educational tools to help you learn more about life insurance and how you can help protect those who matter most even after youre gone.

In addition to the core life insurance offerings, AAA Life provides various services to assist customers with their insurance needs. These include online quote tools, access to licensed insurance professionals, and educational resources. Contact AAA Life today for your free quote.

While exploring your options, remember that switching to AAA car insurance could save you hundreds of dollars on your premiums. Visit AAA to receive your free quote and see how much you can save. Find the right policy for you; Term, express term, whole, or universal insurance. Get a free quote online.

Choosing the right life insurance policy is a crucial decision that requires careful consideration of your individual circumstances and financial goals. By understanding the different types of policies available and the features they offer, you can make an informed choice that provides lasting protection for your loved ones. Premiums will never go up on these permanent policies. There are a variety of AAA.

Protect your loved ones with help from AAA Life Insurance. Choose between $5,000 to $75,000 in coverage, and if approved youre covered for life! Thats why AAA Lifes whole life insurance policy is a perfect choice for those looking for a reliable, affordable whole life insurance policy that doesnt require a medical exam.

By submitting a request, you agree to receive calls, texts or prerecorded messages regarding products and services from AAA Life Insurance Company or AAA partner companies, clubs, agencies, subsidiaries, affiliates or authorized representatives (full list of entities), at the phone number provided above, including your wireless number if provided.

Preparing for my family's future.

Whether youve already chosen a policy or are still exploring, AAA makes it easy to get a quote or get in touch if you have questions.