Are you prepared to navigate the complexities of life insurance, ensuring your loved ones are protected and your financial future is secure? Understanding the nuances of policies, riders, and cash value accumulation is crucial for making informed decisions that safeguard your family's well-being.

When considering life insurance, the choice between term, whole, and universal life policies can feel daunting. Each type offers distinct features and benefits, catering to diverse needs and financial goals. Let's delve into the specifics of each, examining how they function and what they offer policyholders. For instance, in the realm of universal life insurance, it's important to understand the factors that influence premiums, particularly when considering riders like the guaranteed insurability rider. The premium for such riders is calculated based on factors determined at the time the rider is added. This rider, if exercised, allows the insured to purchase additional coverage at specified intervals without having to undergo another medical examination, providing flexibility to adjust coverage as life changes.

Consider "T," an insured/owner of a universal life insurance policy, is concerned about the policy lapsing due to disability. Which rider would come to the rescue to ensure the policy stays in force? The answer lies in a living benefits rider, specifically the waiver of premium rider. This rider ensures that premium payments are waived if the insured becomes disabled, thus preventing the policy from lapsing and ensuring continued coverage.

The concept of riders extends beyond simple waivers. A rider, in essence, is an add-on to a life insurance policy that provides extra protection or benefits, tailoring the policy to the insured's specific needs. These can range from accidental death benefits to provisions for chronic illness or critical care. However, the expiration of most riders prompts an important question: What happens to the overall policy premium? The correct answer is that the premium generally does not change.

Consider a scenario: a $100,000 policy includes a waiver of premium rider and has accumulated $30,000 in cash value. If the base policy costs $750 annually and the rider adds $50, the total annual premium is $800. This illustrates how riders, while offering valuable benefits, contribute to the overall cost of the policy. A key consideration is that cash value is a component of certain permanent life insurance policies, like whole and universal life, serving as a savings component that grows over time.

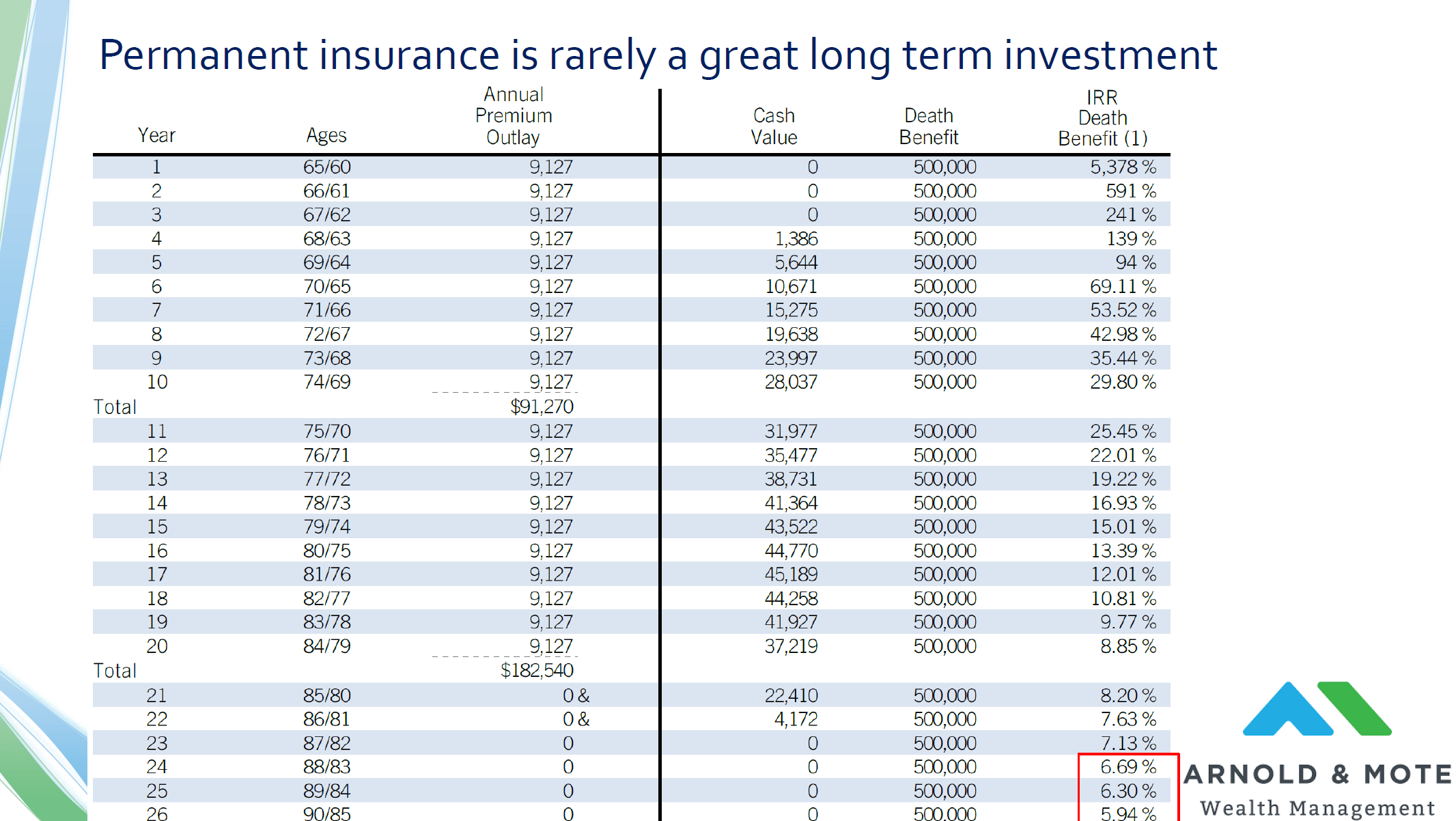

Life insurance isn't merely about death benefits; it's a dynamic tool for financial planning. Permanent life insurance policies, like whole and universal life, last your entire life, providing coverage that never expires. The death benefit is guaranteed, no matter when the policyholder passes away, offering enduring security for beneficiaries. These policies also offer cash value components, which build up savings that can be borrowed against or used for other financial needs.

Let's explore the offerings of AAA Life Insurance. They provide a variety of universal life insurance policies, providing lifetime coverage with flexible premiums, adapting to your evolving needs. These policies may also offer an accumulator universal life insurance which allows policy owners to build cash value, which can be used to help cover final expenses, bolster your retirement savings, and even help skip premiums.

AAA Life Insurance offers two distinct universal life insurance options. The "Lifetime" policy aligns with a guaranteed universal life insurance approach, emphasizing a strong death benefit without extensive cash value accumulation. Premiums are guaranteed to remain level throughout the policy's duration, offering a sense of stability.

In contrast, a universal life policy is a type of permanent life insurance offering both a death benefit and a cash value component, which can grow over time. Universal life insurance is a type of permanent life insurance offering both a death benefit and a cash value component, which can grow over time. It offers flexible coverage designed to provide financial security, while accumulating value for the future. The flexibility of universal life allows you to adjust your premium payments and death benefit within certain limits, providing you with greater control over your policy.

Now, consider "M", the owner of a $100,000 life policy with a triple indemnity rider for accidental death. In such cases, should "M" die in an accident, the death benefit could be significantly increased. The triple indemnity rider will provide three times the face amount. It is crucial to note the rider's stipulations: the death must not be caused by the insured's actions.

A fundamental distinction exists between term and permanent life insurance policies. Many term life insurance policies can be converted into universal life or whole life policies, granting the policyholder additional flexibility. With term life insurance, the insured is covered by death benefit protection, without any cash value or savings build up, whereas the whole and universal policies build a savings component.

Beyond the realm of traditional life insurance, there's also the concept of "viatical settlements." In such arrangements, a terminally ill insured sells their policy to a third party for a percentage of the face amount. This provides immediate financial resources to the insured, but it also means the third party receives the death benefit upon the insured's passing. The benefits may be reduced by any loans and unpaid interest on the policy.

When evaluating term life insurance, it's important to note features such as the waiver of premium provision. This provision ensures that premium payments are waived if the insured becomes disabled, providing peace of mind. These riders also add to the premium. In understanding the structure of a policy, knowing the form series is important; "Whole Life policy form series" or "Lifetime universal life insurance policy form series."

In essence, life insurance serves as a cornerstone of financial security. Whether you're securing a term life policy or exploring the cash value potential of a universal life plan, carefully considering your objectives is imperative.

AAA Life Insurance provides a diverse array of life insurance solutions. These solutions are crafted to offer financial protection when needed most. AAA's offerings encompass term life insurance, which offers death benefit protection without a cash value component, as well as whole life and universal life insurance policies. AAA is a federation of independent clubs throughout the United States and Canada.

For example, a universal life policy empowers you to protect your family financially while accumulating value. This flexibility, combined with the growth potential of the cash value component, makes universal life a viable option. It's particularly suited for those who desire both insurance protection and a potential for financial growth. You can conveniently manage your AAA membership, insurance policies, and services online. Make a payment, update your membership, file or track a claim, find travel reservations, pay your AAA visa credit card, monitor your id theft account, and more.

AAA's accumulator universal life insurance policies offer a powerful option. These allow policy owners to build cash value that can be utilized in various ways. Its not just about paying final expenses; it can also bolster retirement savings or even allow for skipping premium payments. For those seeking coverage that adapts to life's changes while offering financial flexibility, the AAA universal life insurance option is worth considering.

The decisions regarding life insurance have far-reaching consequences. It's wise to seek guidance from insurance professionals. They can help evaluate your specific needs and select the ideal coverage. Take the time to explore the array of options, determine your needs, and secure the financial safety of your loved ones.